30+ How much could i lend mortgage

Ad Check Your FHA Mortgage Eligibility Today. 218480 Average offered APR 15-year fixed.

Category Insights Mercer Capital

Skip The Bank Save.

. Its A Match Made In Heaven. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

Were Americas 1 Online Lender. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Special Offers Just a Click Away.

Average offered loan amount. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders.

However monthly payments are higher on 15-year mortgages than 30-year ones so it can be more of a stretch for the household budget especially for first-time homebuyers. If your mortgage is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 624 you will pay about 615 per month in. This mortgage calculator will show how much you can afford.

A 100000 mortgage with. Find the One for You. The APR contains both mortgage interest and the lender fees to help give a more complete picture of loan costs.

The amount of money you spend upfront to purchase a home. Choose Wisely Apply Easily. A 20 down payment is ideal to lower your monthly payment avoid.

So for example if you had an annual salary of 200000. Get Started Now With Quicken Loans. Longer terms usually have higher rates but lower.

Ad 2022s Best Mortgage Lenders Comparison. The remaining 30 is personal interest and is generally not deductible. To get an idea how much youll pay.

The first step in buying a house is determining your budget. When it comes to approving individual borrowers California banks and mortgage lenders often use the debt-to-income ratio DTI to decide how much to lend. Find out how much you could borrow.

Common mortgage terms are 30-year or 15-year. The APR was 615 last week. New lending rules rolled out in January 2014.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Looking For A Mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Fill in the entry fields and click on the View Report button to see a. Ad Compare Mortgage Options Get Quotes.

A mortgage loan term is the maximum length of time you have to repay the loan. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation.

Use Our Comparison Site Find Out Which Lender Suites You The Best. Its A Match Made In Heaven. Ad Compare the Lowest Mortgage Rates.

Most fixed-rate mortgages are for 15 20 or 30-year terms. States where 15-year year fixed mortgages could save borrowers the least 1. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Apply Easily And Get Pre Approved In a Minute. Were Americas 1 Online Lender. Ad Calculate Your Payment with 0 Down.

Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate. Looking For A Mortgage. This is what the lender charges you to lend you the money.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Ad Compare Mortgage Options Get Quotes. How much you can borrow for a mortgage in.

They look at the. Most home loans require a down payment of at least 3. Medium Credit the lesser of.

For this reason our calculator uses your. The average rate on a 30-year fixed-rate loan is now at 602 the highest its been since 2008. The average rate on a 30-year.

Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Interest ratethe percentage of the loan charged.

Mortgage rates took another big leap this week. You may qualify for a loan amount of 252720 and your total monthly mortgage. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Get Started Now With Quicken Loans. Savings Include Low Down Payment. A shorter period such as 15 or 20 years typically includes a lower interest rate.

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

30 Money Saving Challenges To Start Today 52 Week Money Saving Challenge Money Saving Strategies Money Saving Plan

30 Best Passive Income Ideas Clever Girl Finance

Post By Edmund Simms Commonstock Fed Watch Credit Creation Cause Effect August 10 2022

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

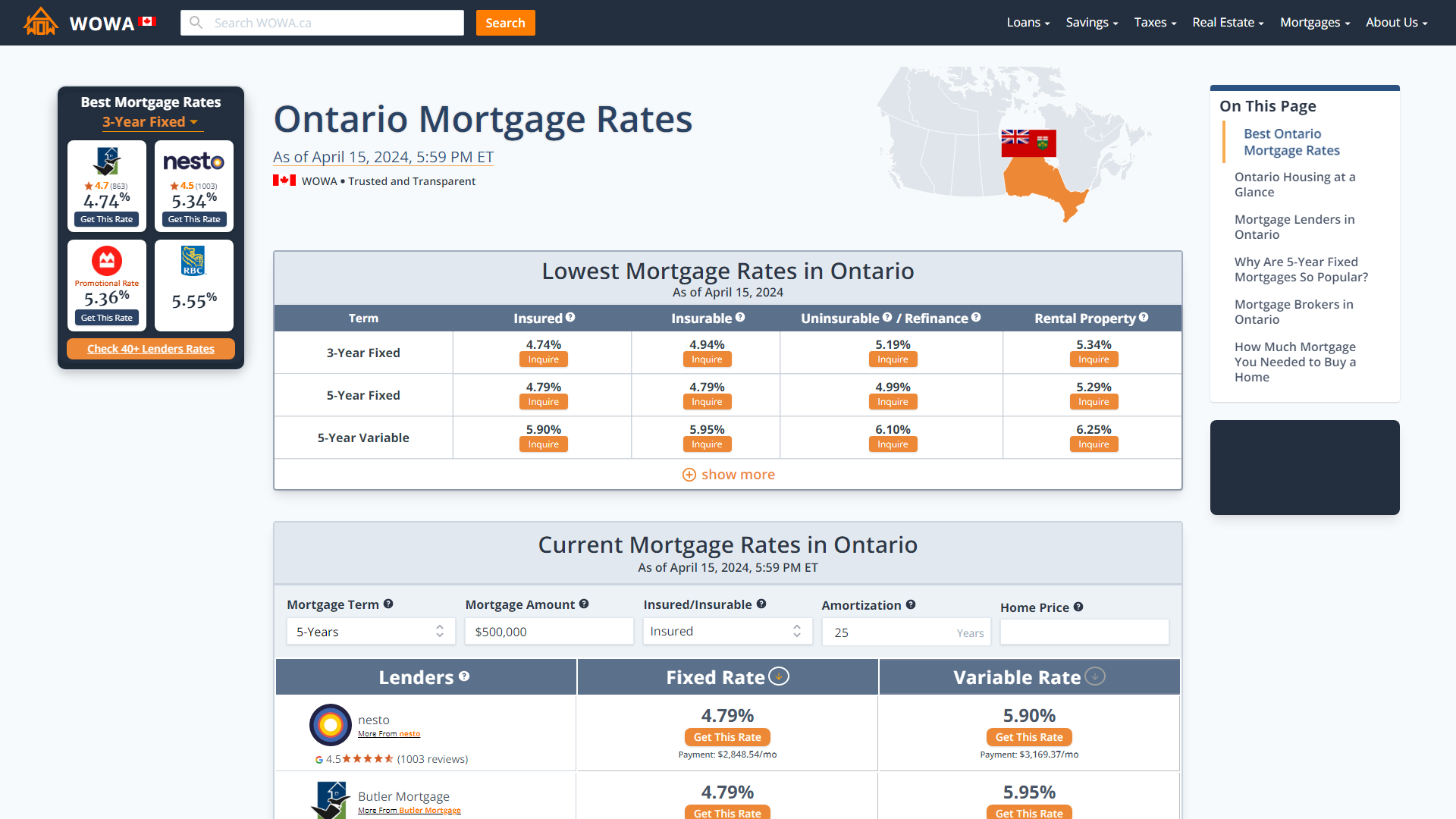

Ontario Mortgage Rates From 30 Ontario Lenders Wowa Ca

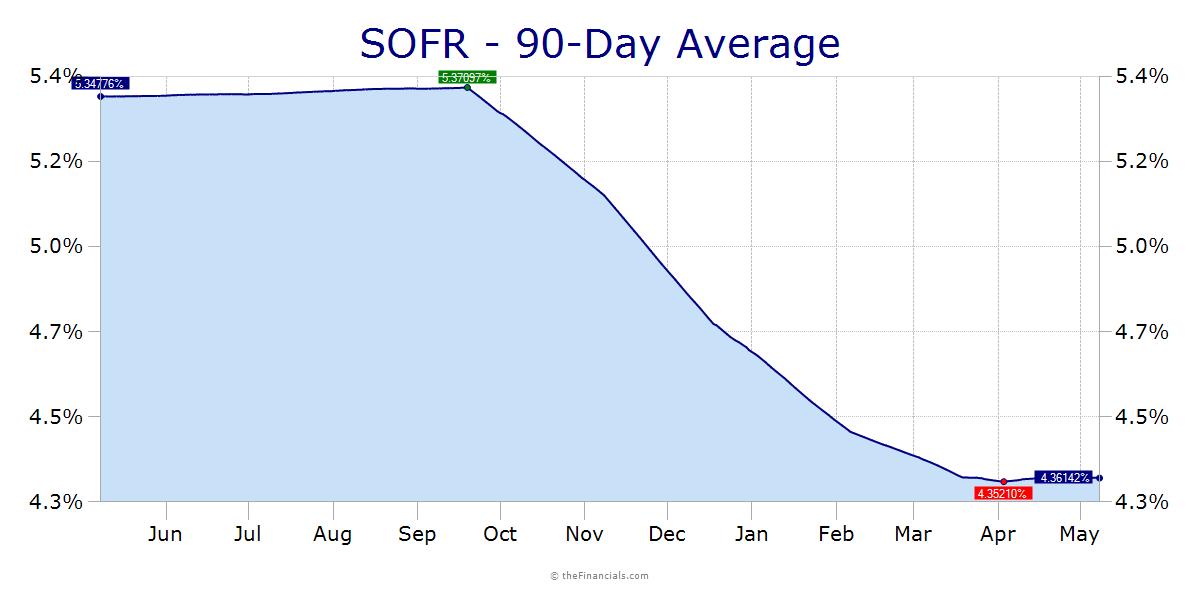

Why Are Interest Rates So Low

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

Get To Know Your Alternative Lenders And Their Niches Part 2

Mortgage Renewals Transfers In Toronto Outline Financial

30 Best Passive Income Ideas Clever Girl Finance

Quotes Motivation Success Entrepreneurship Business Cool Words Thinking Of You Words

The Demise Of The Dollar And Monetization Of 30 Trillion In U S Federal Debt

30 Money Saving Challenges To Start Today Travel Savings Plan Money Saving Challenge Money Saving Strategies

How Do High Interest Rates Affect The Housing Market Quora

Mortgage Lender Woes Wolf Street

Glbhxpi Vi9cym